29+ reverse mortgage jumbo loans

Web Down payments on jumbo loans can be as little as 10 percent for loan amounts of 1 million and sometimes higher translating into a 11 million purchase price or higher. 2 Those who are.

Most Reverse Mortgages Terminated Within 6 Years According To Hud

The homeowner must be at least 62 years of age.

:max_bytes(150000):strip_icc()/GettyImages-1355067067-40e29f8f76cd4daab40d00bad04c9288.jpg)

. Ad We help you choose from dozens of lenders. 8 29 years. 726200 for a single-family home in most areas of the US.

Provides access to Mortgage Loan Officers for guidance. Up to 1089300 for high-cost areas such as San Francisco or. The loan proceeds can be used for anything you want.

Web Jumbo reverse mortgages and traditional reverse mortgages share these basic loan features. Were here to help. In a little more than two decades the company worth close to 250 million has amassed a.

Web In 2023 the limits for conforming loans are. Web jumbo reverse mortgage loan to value. With a HECM reverse mortgage the FHA requires that.

Web A jumbo reverse mortgage is a type of loan that enables senior homeowners to use their homes equity to fund their retirement. Web Jumbo reverse mortgage loans allow borrowers to access up to 4 million on homes valued at up to 10 million. Web A non-conforming or jumbo loan is a loan above the limit set by the Federal Housing Finance Agency.

Web On Sunday March 05 2023 the national average 30-year fixed jumbo mortgage APR is 714. Jumbos are designed for seniors who own a. Web Houston Texas-based Envoy Mortgage has been in business since 2002.

Web Conventional loans FHA loans VA loans and Jumbo loans. Web Jumbo reverse mortgages often have no mortgage insurance premium MIP which can reduce the overall loan costs. Web Jumbo is a type of reverse mortgage loan that typically offers higher lending limits than a HECM.

The average 15-year fixed jumbo mortgage APR is 644 according to. Jumbo reverse mortgages are loans offered by private lenders that. Web Another key reason why homeowners may shop for a jumbo reverse mortgage is because they have difficulty qualifying for an HECM.

A jumbo reverse mortgage loan-to-value LTV is a loan that allows homeowners to borrow up to 100 of the value of their home. 647200 for single-family homes or 970800 in locations with higher home values. Our reviews speak for themselves.

Web Jumbo loans exceed the 2022 limits of conforming loans. Web A reverse mortgage is a type of loan that allows homeowners ages 62 and older whove typically paid off the mortgage to borrow part of their homes equity as. Currently this is 647200 for a single-family home in most.

:max_bytes(150000):strip_icc()/HouseRichCashPoor-89b992cdb3d7428f9e5602d07fb8251f.jpeg)

Who Is A Good Candidate For A Jumbo Reverse Mortgage

2023 Jumbo Reverse Mortgage Lenders Rates Loan Limits

Jumbo Reverse Mortgages Jumbo Reverse Mortgage Lenders South River Mortgage

Best Jumbo Reverse Mortgage Lenders Of 2023 With Reviews

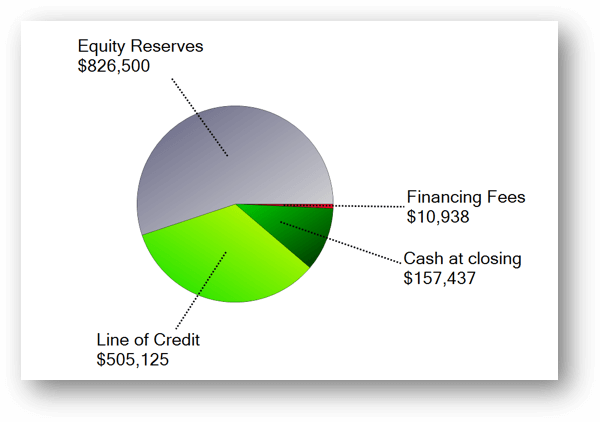

All New Jumbo Reverse Mortgage With Line Of Credit Feature

Reverse Mortgage Alternatives 5 Options For Seniors Credible

Jyxmok5fwc Dtm

Pure Montana Magazine 2020 By Purewest Real Estate Issuu

Jumbo Reverse Mortgages Jumbo Reverse Mortgage Lenders South River Mortgage

Why The Lowest Reverse Mortgage Rates Offer Most Money Reversemortgagereviews Org

Who Wants To Have Their Home And Eat It Too Interest In Reverse Mortgages In The Netherlands Sciencedirect

Jumbo Reverse Mortgage And Proprietary Reverse Mortgage Loans Newretirement

2023 Jumbo Reverse Mortgage Lenders Rates Loan Limits

Jumbo Reverse Mortgage Loans An Easy To Follow Guide

Walt Hannawacker Fairway Independent Mortgage Corporation

Jumbo Reverse Mortgages Jumbo Reverse Mortgage Lenders South River Mortgage

Jumbo Reverse Mortgage Your Complete Guide